The future for metal fasteners

Submitted by:

Sara Waddington

In the March 2025 issue of ISMR, we outline the latest new trends, challenges and developments in global industrial metal fastener markets.

====

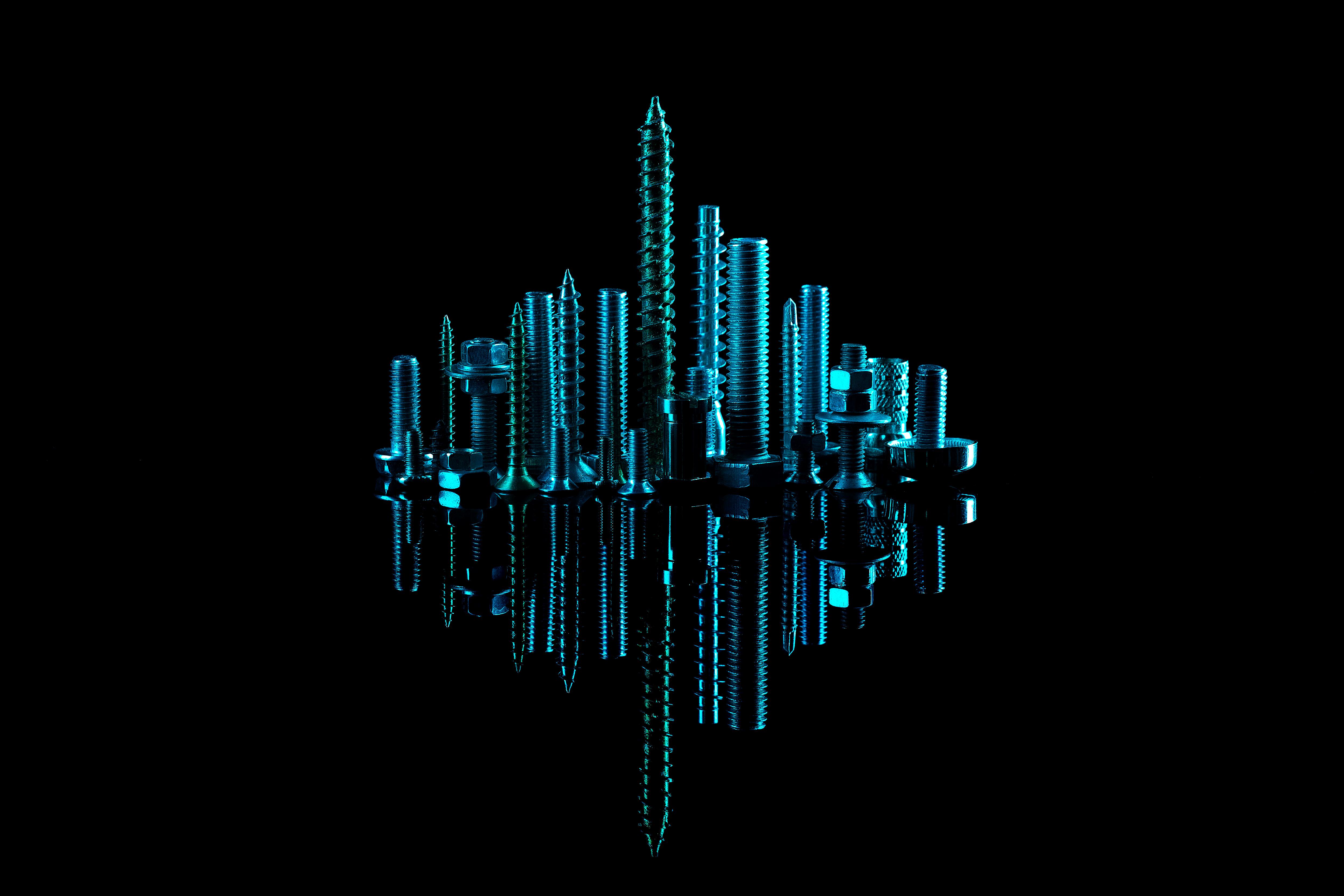

Industrial fasteners are components used to join two or more objects permanently or semi-permanent. They include nuts and bolts; threaded rods; structural bolts; machine screws; wedge anchors; washers; rivets and more in various types and sizes. They are available in various standard shapes, sizes and materials, and can also be produced customarily for specific needs. They are used to combine multiple components from sheet metal, plastics or other materials.

Metal fasteners are manufactured from various materials such as steel, stainless steel; brass; aluminium; bronze; nickel; copper; titanium and other non-ferrous metals. The selection of material by end users is primarily based on considerations such as strength required; presence of corrosive environment; stresses; weight; electrical and magnetic properties; electrical; plating/coating required; expected life and reusability.

Steel (as well as alloy steel and low and medium-carbon steel) is a key material for fasteners. Other materials such as titanium; aluminium and different alloys are also used to make metal fasteners. Special coatings or plating are also applied to metal fasteners to increase their performance characteristics. Zinc, chrome and hot-dip galvanizing are standard coating/plating techniques for fasteners. Fastener manufacturing primarily includes casting, forming, machining and thread production.

Global fastener markets

According to analyst Grand View Research, the global industrial fasteners’ market size was estimated at US$ 95.57 billion in 2023 and is expected to grow at a CAGR of 4.7% from 2024 to 2030.

“The market is expected to be driven by the growing population, high investments in the construction sector and rising demand for industrial fasteners in the automotive and aerospace sectors. Infrastructure development is one of the key parameters to be considered while tracking the regional development of the market,” said the analyst.

“The market for industrial fasteners is characterised by intensive technological developments that produce advanced, lightweight products for automotive and other industrial applications. With the enhancement in technology, the rising demand for hybrid fasteners (which incorporate a combination of injection-moulded plastic components with metal elements) is expected to drive the market,” it added.

Companies manufacturing fasteners require significant capital investment owing to the high production volumes and stringent specifications concerning testing and labelling. Industrial fasteners such as bolts, screws, nuts, studs and rivets are manufactured and distributed by different participants. Companies invest significantly in R&D activities, resulting in dynamic market conditions.

“The market growth stage is medium, and the pace of growth is accelerating. The market is fragmented and highly competitive, with various large and small-scale manufacturers in China, Taiwan, Thailand and Japan. Significant development of commercial construction, coupled with the rising demand for green building materials in the region, has triggered market growth, improving competition in the market,” outlined Grand View Research.

“Metal fasteners accounted for the largest market share of 91.15% in 2023. This includes various materials such as stainless steel, bronze, cast iron, superalloys and titanium. High mechanical strength is expected to be an important factor triggering their growth over the forecast period,” continued the analyst.

According to Grand View Research, externally threaded fasteners accounted for the highest revenue share of 48.08% in 2023. Bolts and screws, it said, are the most widely utilised type of externally threaded fasteners. Non-threaded fasteners accounted for the second-largest revenue share in 2023 and were expected to drive significantly over the forecast period. Rising demand for non-threaded fasteners in the construction industry for various applications (such as subflooring, decking and roofing) is expected to positively impact growth over the projected period (2024-2030).

“Aerospace-grade fasteners are expected to expand at the fastest CAGR of 6.0% from 2024 to 2030. These fasteners vary significantly from ordinary commercial-grade fasteners in terms of quality, performance, raw material, price and other technical specifications. The most commonly used aerospace nuts include fibre inserts and castle nuts. Internally threaded fasteners accounted for a significant share of the market. Stainless steel is the most common material used for manufacturing internally threaded industrial fasteners, followed by brass, alloy steel and aluminium. Innovations in the designs of internally threaded fasteners to provide better performance and high impact and vibration resistance are projected to impact growth positively,” added the analyst.

The industrial fasteners’ market in Asia Pacific accounted for the largest revenue market share, with 44.05% in 2023, explained Grand View Research. Economic growth in Asia has increased the need for improved public infrastructure such as roads, harbours, airports and rail transportation networks. Furthermore, a substantial increase in mergers & acquisitions, integration activities and site relocations has boosted industrial development in the region. This has resulted in increased construction of industrial and infrastructure activities in emerging nations such as India, Vietnam, Thailand and Malaysia.

Trends and developments

Trends in fastener markets include an increased focus on lightweighting in the automotive and aerospace sectors and growing investments in industrial automation, motion control and robotics. There has been increasing use of novel threaded and plastic fasteners and substantial technology innovations in fastener forms and functions. Electric vehicle supply chain opportunities include the manufacture of housings and enclosures to protect battery packs and electric drive components; precision fastening and mounting systems; cooling systems; connectors and cabling.

A rising wave of miniaturisation is also driving demand for micro fasteners and miniature fasteners in various types and styles. Miniature clinch fasteners offer strong, permanent and reusable fastener solutions in applications utilising ultra-thin metal sheets.

In general, a major challenge faced by fastener manufacturers is the fluctuation of raw material prices. Metal fastener replacement by plastic fasteners, automotive tapes and adhesives are also key barriers for metal fastener manufacturers. Plastic fastener manufacturers are expected to gain from this because of the rising demand for lightweight components from automotive manufacturers.

To read the rest of this article in the March 2025 issue of ISMR, please see https://joom.ag/EKMd/p18