North American robot orders increase 67% in Q2 2021

Submitted by:

Sara Waddington

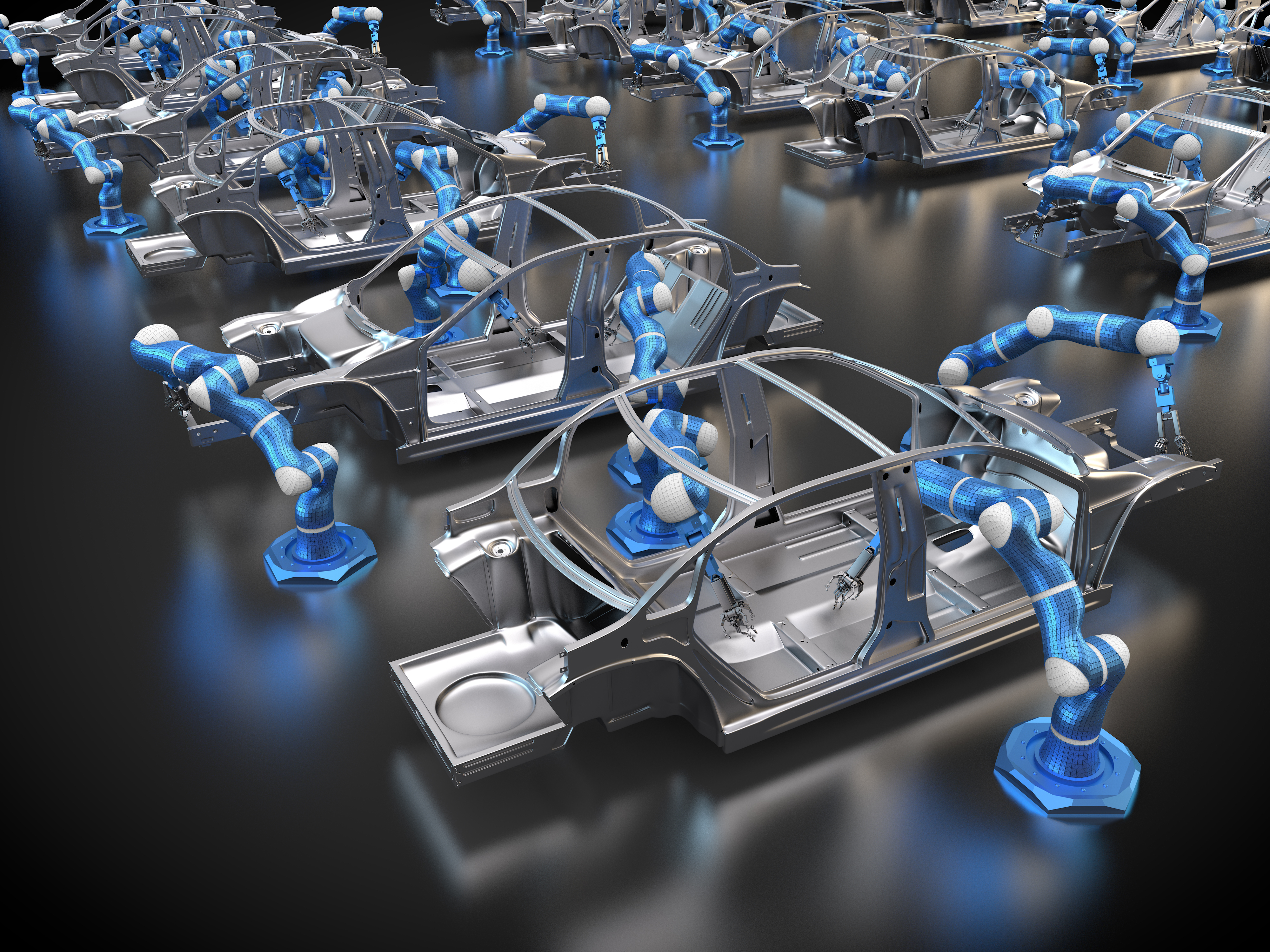

Robot orders in the second quarter of 2021 in North America were up by 67% over the same period in 2020, showing a return to pre-COVID 19 pandemic demand for automation as manufacturers and other North American companies return to business. According to the Association for Advancing Automation (A3), North American companies ordered 9,853 robots valued at US$ 501 million in Q2 2021, up from 5,196 sold in Q2 2020, the peak of the pandemic.

The Q2 2021 increase, which marks the third-highest quarter on record for robot units sold overall, also showed more than half (5,530) came from non-automotive customers as industries such as metals; semiconductor & electronics; plastics and rubber; food and consumer goods; and life sciences recognize the benefits of automation.

“With the big increases in automation sales, and favourable economic conditions in the U.S. manufacturing sector throughout much of 2021, it is clear that users have accelerated their orders for robotics and other forms of advanced technologies,” said Jeff Burnstein, President, A3.

“While companies have long realized that automation increases efficiencies, expands production and empowers human employees to do more valuable tasks, the pandemic helped even more industries realize those benefits. By automating—either for the first time or expanding on how they use automation—companies will be better prepared to handle any upcoming issues that impact their business,” he added.

According to A3, the substantial increases in robot orders in Q2 came from companies in metals (up 99% over Q2 2020); automotive components (up 85%); semiconductor & electronics/photonics (up 62%); plastics & rubber (up 51%); food & consumer goods (up 51%); automotive OEM (up 49%) and life sciences/pharmaceutical/biomed (up 21%).

In addition to the large increase in robotic orders, machine vision, motion control and motor markets saw record increases over Q2 2020, A3’s report shows. North American machine vision statistics reveal that the market expanded 26% to US$ 764 million, a new record. For January through to June 2021, the North American machine vision market grew 18% to US$ 1.5 billion, which ‘is the best start to a year on record’, according to A3.

The motion control and motors sector recorded US$ 1.065 billion in shipments, 13% greater than Q2 2020 sales and setting a new record. Motors, actuators and mechanical systems and electronic drives saw the largest increases.

“The revitalisation of automation that we’re seeing across myriad industries is extremely encouraging,” Burnstein added. “Not only will the increase in automation use be a win for our member companies, but it will also help the U.S. economy grow even more as customers increase productivity and fill the millions of manufacturing jobs that remain unfulfilled.”

For further details, see https://www.automate.org/