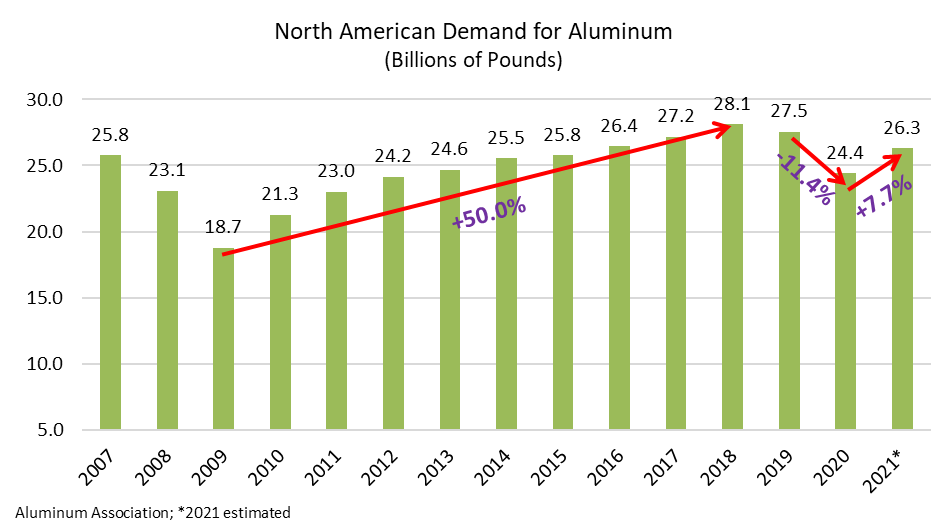

U.S. aluminium demand outpaces GDP growth

The Aluminum Association in the U.S. has released preliminary estimates as part of its monthly ‘Aluminum Situation’ report, showing an estimated 7.7% demand growth for the aluminium industry in North America (U.S. and Canada) in 2021. This outpaced estimated 5.7% Gross Domestic Product (GDP) growth in the United States in 2021.

Aluminium demand recovered strongly in 2021 following a demand decline of 11.4% between 2019 and 2020 during the COVID-19 pandemic. Among key takeaways from the report were:

- Aluminium demand in the United States and Canada (shipments by domestic producers plus imports) totalled an estimated 26.3 million pounds in 2021, approaching pre-pandemic levels.

- All major semi-fabricated (or “mill”) product categories saw increased year-over-year demand growth in 2021, led by extruded products (15.9%) and sheet and plate (14.4%). In total, mill product demand grew 13.5% year-over-year.

- Aluminium exports (excluding scrap) to foreign countries declined 20.4% in 2021.

- Aluminium scrap exports increased 16.0 per cent over the 2020 level.

- Net new orders for mill products remained above the baseline of 100 throughout 2021, the first year that has occurred since the association re-set the Index back in 2013.

- Imported aluminium and aluminium products into the North America (U.S. and Canada) grew by 21.3% year-over-year in 2021, amidst higher demand, but are still nearly 25% below 2017 volumes.

“Taken together, this latest data shows an industry in strong recovery mode,” said Charles Johnson, President & CEO of the Aluminum Association. “Despite the lingering challenges of the COVID-19 pandemic, geopolitical issues and supply chain challenges, the U.S. aluminum industry shows signs of robust growth in a number of markets.”

Following a lull in capital expenditure in 2020, the U.S. aluminium industry has announced more than US$ 800 million in domestic investment over the past six months. This contributes to more than US$ 4 billion invested by the industry over the past decade to capture demand growth for sustainable, recyclable products in the automotive, packaging, building and construction and other sectors. Strong trade enforcement efforts in targeted markets have also led to industry investment over the past few years.

The Aluminum Association represents aluminium production and jobs in the United States, ranging from primary production and value-added products to recycling, as well as suppliers to the industry. The association represents companies that make 70 per cent of the aluminium and aluminium products shipped in North America. In the U.S., the aluminium industry supports US$ 172 billion in economic activity and nearly 660,000 jobs. See https://www.aluminum.org

Recent comments